Health care is traditionally one of the largest expenses in retirement. Planning for these costs, and keeping up with it as you age is crucial.

Given variation in health care cost inflation from year to year, it may be prudent to assume an annual health care inflation rate of 6.5% which may require growth as well as current income from your retirement portfolio.

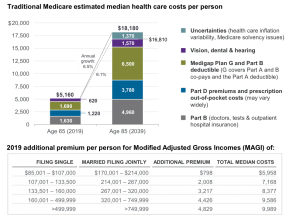

This chart illustrates the current out-of-pocket health care costs experienced by today’s 65-year-old, and how those costs may increase over time. These costs include traditional Medicare with a Medigap Plan G, which is fairly comprehensive. Supplemental policies, called Medigap, fill in gaps in Medicare coverage such as co-pays and deductibles but not for most prescriptions. Part D for prescription drugs and out-of-pocket expenses are also included. Median costs are about $5,160 per person. These costs are projected to more than triple over 20 years for three reasons: 1) higher than average inflation for health care expenses; 2) increased use of health care such as drugs at older ages; and 3) Medigap premiums that increase not only with inflation but also due to increased age. It is important to note that these costs do not include most long-term care expenses.