Park + Elm Investing Principle #6: Practice Smart Diversification

PRINCIPLE #6 IS HERE!

PRACTICE SMART DIVERSIFICATION!

Download the rest of our Ebook Here to get all 10 principles!!

It’s not enough to diversify by security. Deeper diversification involves geographic and asset class diversity. Holding a global portfolio helps to lower concentration in individual securities and increase diversification.

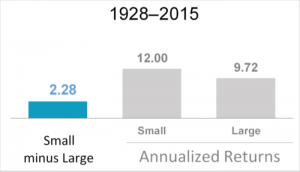

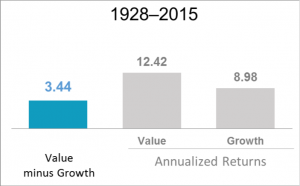

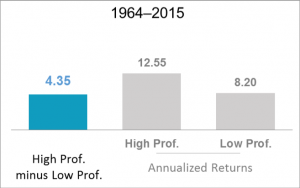

Over long periods of time, investors can benefit from consistent exposure in their portfolios to both US and non-US equities. While both asset classes offer the potential to earn positive expected returns in the long term, they may perform quite differently over shorter cycles. The performance of different countries and asset classes will vary over time, and there is no reliable evidence that performance can be predicted in advance. An approach to equity investing that uses the global opportunity set available to investors can provide both diversification benefits as well as potentially higher expected returns.

The global equity market is large and represents a world of investment opportunities. Nearly half of the investment opportunities in global equity markets lie outside the United States. Non US stocks including developed and emerging markets, account for 47% of world market cap and represent more than 10,000 companies in over 40 countries. A portfolio investing solely within the US would not be exposed to the performance of those markets.

However, when Americans talk about the stock market, they’re generally referring to the Standard & Poor’s 500 index or the Dow Jones industrial average. But these indices represent only one part of the available investing universe. The total U.S. stock market makes up only about 53% of global market capitalization. Yet, on average, U.S. mutual fund investors possess a home bias, with a disproportionate amount of their portfolio invested in the United States. If their portfolios were balanced according to world market capitalization, about half of their assets would reside in non-U.S. stocks. This “home bias” leads to less diversification, and as a result, greater volatility with lower returns.

It’s well know that concentrating in one stock exposes you to unnecessary risks, and diversifying can reduce the impact of any one company’s performance on your wealth. From year to year, you never know which markets will outperform, and attempting to identify future winners is a guessing game. Diversification improves the odds of holding the best performers, and by holding a globally diversified portfolio, investors are positioned to capture returns wherever they occur.

Put very simply, DIVERSIFICATION:

· Helps you capture what global markets offer

· Reduces risks that have no expected return

· May prevent you from missing opportunity

· Smooths out some of the bumps

· Helps take the guesswork out of investing

There is no single perfect portfolio. There are an infinite number of possibilities for allocation based on the needs and risk profile of each individual. The most important question investors should ask… “IS MY PORTFOLIO GLOBALLY DIVERSIFIED?”