Pursuing a Better Investment Experience #7: Avoid Market Timing

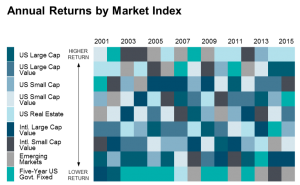

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur. Trying to correctly time your entry point to the market is difficult, and unfortunately humans have an instinctive desire to take control and make a change when things aren’t moving in the direction we want.

The problem is that what appears to be an intelligent alternative may actually be a distraction. Remember, hindsight is twenty-twenty. There are always short-term investments that do better than a balanced portfolio, but chasing returns is dangerous. What works is having a successful investment strategy and the discipline to stick with it.

Market timing is a seductive strategy. If we could sell stocks prior to a substantial decline and hold cash instead, our long-run returns could be exponentially higher. But successful market timing is a two-step process: determining when to sell stocks and when to buy them back. I can think of a couple of recent examples where getting these two key things correct would have been extremely difficult and maybe even impossible.

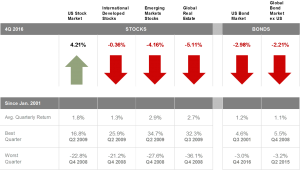

First, leading up to the presidential election, everyone predicted that a victory for Donald Trump would send the stock market into a tailspin. Nearly every media outlet predicted a market crash if Trump won, and many investors took the advice and withdrew. Yet after some brief jitters following Trump’s win, the stock market has kept marching skyward. By the time Trump clinched the presidency, the market rallied and closed the trading day 256 points higher, and has not shown any opportunity to re-enter efficiently.

And let’s not forget the Brexit news of last summer. Wasn’t Britain’s exit from the European Union finally the trigger of the next Stock Market crash? If you read the headlines and listened to the noise, you may have sold your stocks back in late June when the DJIA was just over 18,000. Four days after Brexit, the market stabilized and began its steady incline to the 19,804 that we are at today.

So how do we get our egos and emotions out of the investment process? One answer is to distance ourselves from the daily noise by appointing a financial advisor to help stop us from doing things against our own long-term interests. Investment advice is not about making predictions about the market. It’s about education and diversification and designing strategies that meet the specific needs of each individual. Ultimately it’s about saving investors from their own, very human, mistakes. What often stops investors from getting returns that are there for the taking are their very own actions—lack of diversification, compulsive trading, buying high, selling low, going by hunches and responding to media and market noise.

An advisor begins with the understanding that there are things we can’t control (like the ups and downs in the markets), and things we can (like proper diversification, rebalancing, minimizing fees, and being mindful of tax consequences). Most of all, an advisor helps us all by encouraging the exercise of discipline—the secret weapon in building long-term wealth.

Working with markets, understanding risk and return, diversifying and portfolio structure—we’ve heard the lessons of sound investing over and over. But so often the most important factor between success and failure is ourselves. Do you have a plan for navigating the “media noise”, and avoiding the temptation to time the market?