Pursuing a Better Investment Experience #1: EMBRACE MARKET PRICING

Many investors believe that there may be a way to predict when to buy and sell securities, and it’s possible that pricing errors occur in financial markets. But it’s clear that investors have a very difficult time consistently exploiting these errors. Over the last five years…

- About 60% of actively managed large cap US equity funds have failed to beat the S&P 500

- 77% of mid cap funds have failed to beat the S&P 400

- Two-thirds of the small cap manager universe have failed to outperform the S&P Small Cap 600 Index.

- Across the thirteen fixed income fund categories, all but one experienced at least a 70% rate of underperformance over five years.

…and the underperformance rate increases over longer periods of time. Most investors have investment time horizons much broader than 5 years, so trying to anticipate market movements over decades adds extreme anxiety and undue risk, while drastically increasing management expenses. Although the promise of above-market returns is alluring, investors must face the reality that as a group, US-based active managers do not consistently deliver on this promise, and they charge significantly higher fees for this underperformance.

Consider the assumption that the price of a security reflects all available information, and the intense competition among market participants drives prices to fair value. This type of strong belief in markets frees us to think and act differently about investing. When you try to outwit the market, you compete with the collective knowledge of millions of investors. By harnessing the Market’s power, you can put their knowledge to work in your portfolio.

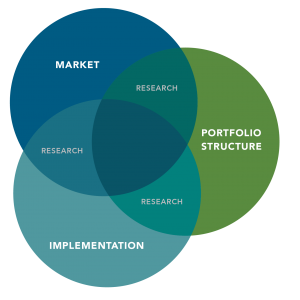

Markets throughout the world have a history of rewarding investors for the capital they supply, and persistent differences in average portfolio returns are explained by differences in average risk. Attempting to time the market creates periods of time when investors are out of the market. This lack of participation can prove very costly to long-term returns. At Park and Elm, we embrace the market, and put investors in a position to capture returns from market growth over time, by pinpointing an acceptable level of risk, for an acceptable long-term return. There are periods of good and bad in the stock market, but it is by far the BEST investment option we have. Understanding that the price of a stock is driven to fair value by the intense competition of companies and investors, allows us to focus on controlling risk, lowering fees and diversifying into the broader markets.

Stay tuned-in to our blog for our Ten Part Series highlighting TEN decisions that can help investors target long-term wealth in capital markets. We’ll cover topics from market pricing, efficient markets and diversification; to investing with your emotions, and the Media challenging your discipline. Check back tomorrow for the first of the series: EMBRACE MARKET PRICING

Stay tuned-in to our blog for our Ten Part Series highlighting TEN decisions that can help investors target long-term wealth in capital markets. We’ll cover topics from market pricing, efficient markets and diversification; to investing with your emotions, and the Media challenging your discipline. Check back tomorrow for the first of the series: EMBRACE MARKET PRICING extensive market report…the

extensive market report…the