COSTS MATTER. Whether you’re buying a car or selecting an investment strategy, the costs you expect to pay are likely to be an important factor in making any major financial decision.

People rely on a lot of different information about costs to help inform these decisions. When you buy a car, for example, the sticker price tells you approximately how much you can expect to pay for the car itself. But the sticker price is only one part of the overall cost of owning a car. Other things like sales tax, the cost of insurance, expected routine maintenance costs, and the potential cost of unexpected repairs are also important to understand. Some of these costs are easily observed, and others are more difficult to assess. Similarly, when investing in mutual funds, different variables need to be considered to evaluate how cost‑effective a strategy may be for a particular investor.

Expense ratios

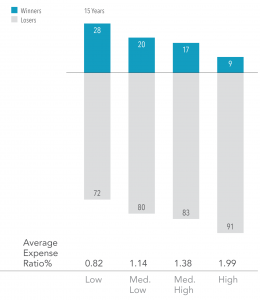

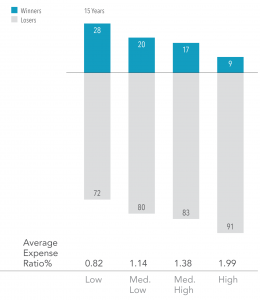

Many types of costs lower the net return available to investors. One important cost is the expense ratio. Similar to the sticker price of a car, the expense ratio tells you a lot about what you can expect to pay for an investment strategy. Exhibit 1 helps illustrate why expense ratios are important and shows how hefty expense ratios can impact performance.

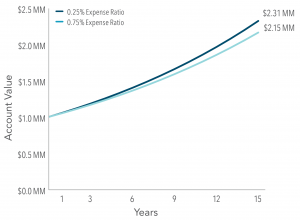

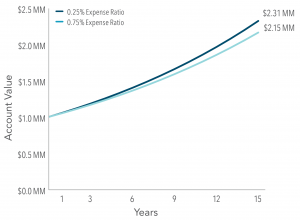

This data shows that funds with higher average expense ratios had lower rates of outperformance. For the 15-year period through 2016, only 9% of the highest-cost equity funds outperformed their benchmarks. This data indicates that a high expense ratio is often a challenging hurdle for funds to overcome, especially over longer horizons. From the investor’s point of view, an expense ratio of 0.25% vs. 0.75% means savings of $5,000 per year on a $1 million account. As Exhibit 2 helps to illustrate, those dollars can really add up over longer periods.

Exhibit 1. High Costs Can Reduce Performance, Equity Fund Winners and Losers Based on Expense Ratios (%)

Exhibit 2. Hypothetical Growth of $1 Million at 6%, Less Expenses

For illustrative purposes only and not representative of an actual investment.

While the expense ratio is an important piece of information for an investor to evaluate, what matters most when gauging the true cost‑effectiveness of an investment strategy is the “total cost of ownership.” Similar to the car example, total cost of ownership is more holistic than any one figure. It looks at things that are readily observable, like expense ratios, but also at things that are more difficult to assess, like trading costs and tax impact. It is important for investors to be aware of these and other costs and to realize that an expense ratio, while useful, is not an all‑inclusive metric for total cost of ownership.

Trading costs

For example, while an expense ratio includes the fund’s investment management fee and expenses for fund accounting and shareholder reporting (among other items), it doesn’t include the potentially substantial cost of trading securities within the fund. Overall trading costs are a function of the amount of trading, or turnover, and the cost of each trade. If a manager trades excessively, costs like commissions and the price impact from trading can eat away at returns. Viewed through the lens of our car analogy, this impact is similar to excessively jamming your brakes or accelerating quickly. By regularly demanding immediacy like this when it may not be necessary, the more wear and tear your car is likely to experience and the more fuel you will end up using. These actions can increase your total cost of ownership. Additionally, excessive trading can also lead to negative tax consequences for the fund, which can increase the cost of ownership for investors holding funds in taxable accounts. The best way to try to decrease the impact of trading costs is for funds to avoid trading excessively and pay close attention to effectively minimizing cost per trade. Employing a flexible investment approach that reduces the need for immediacy, thereby enabling opportunistic execution, is one way to potentially help accomplish this goal. Keeping turnover low, remaining flexible, and transacting only when the potential benefits of a trade outweigh the costs can help keep overall trading costs down and help reduce the total cost of ownership.

Conclusion

The total cost of ownership of a mutual fund can be difficult to assess and requires a thorough understanding of costs beyond what an expense ratio can tell investors on its own. A good advisor can help investors look beyond any one cost metric and instead evaluate the total cost of ownership of an investment program—and ultimately help clients decide if a given strategy is right for them.