PRINCIPLE #8 IS HERE!

Do Emotions affect Investment Returns!

Download the rest of our Ebook Here to get all 10 principles!!

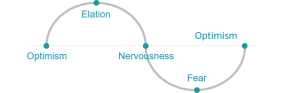

Many people struggle to separate their emotions from investing. The chart above shows the correlation between emotional cycles and market returns. Investors typically buy at “Elation” and sell at “Fear”, inherently creating a dreaded “selling low, buying high” strategy.

A philosopher once said that nothing is as difficult for people as not deceiving themselves. But while most self-delusions are relatively costless, those relating to investment can come with a hefty price tag.

Market volatility in 2008 and 2009 took investors on a bumpy, emotional ride. Despite the market’s strong performance after March of 2009, many investors were too exhausted to endure the ongoing stress of an uncertain economy and market. By making an emotional decision to avoid the stress, there are millions of investors who never recovered their losses and sacrificed the enormous gains that would follow.

On the contrary – prior to the tech bubble of the early 2000’s, investors were pumping money into the dot coms because they saw their neighbor or co-worker getting rich. Driven by media and emotional investing, American’s poured their savings into tech stocks, only to endure the bubble bursting in 2000.

Some media outlets claim a similar bubble for tech stocks in ‘15 and ‘16. A Bing search on this claim literally pulled up the following article titles, one after another on page 1:

“Why this Tech Bubble is Worse than the Tech Bubble of 2000”

“Why this Tech Bubble is Less Scary than the Tech Bubble of 2000”

Magazines sell by appealing to the emotions of a reader. When it comes to investments, reacting to what you read or see on TV can be detrimental to your long-term retirement plan. Keep these tips in mind before making an emotional investment decision:

- Market timing is hard.

- Never forget the power of diversification.

- Markets and economies are different things.

- Discipline is rewarded.

Overcoming self-deception is not impossible. It just starts with recognizing that, as humans, we are not wired for disciplined investing. We will always find one way or another of rationalizing an emotional reaction to market events. But that’s why even experienced investors engage advisors who know them, and who understand their circumstances, risk appetites, and long-term goals. The role of your advisor is to listen to and acknowledge your very human fears, while keeping us in the plans we committed to at our most lucid and logical moments. Can you say with confidence that your investment decisions are based on a long-term strategy, or are your current emotions playing a role?