Principle #5 is HERE!

Consider the Drivers of Returns!

Download the rest of our Ebook Here to get all 10 principles!!

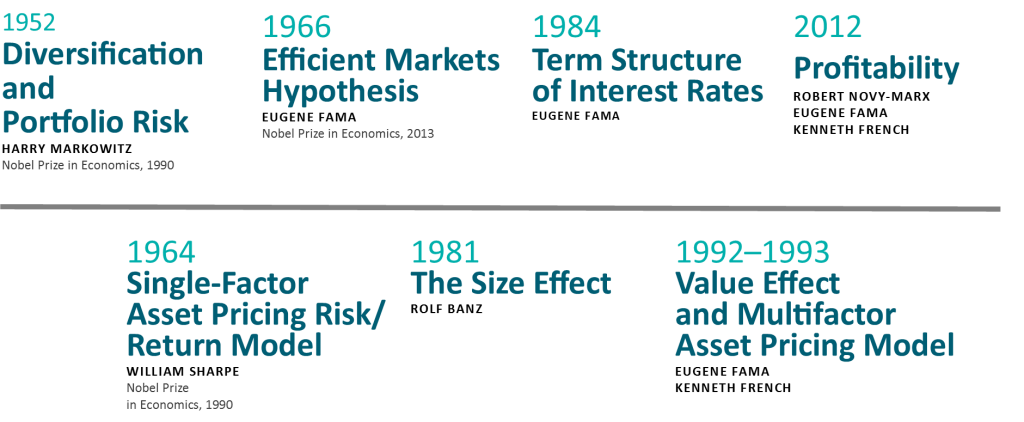

Throughout history, many of the greatest advancements in finance have come from Academia. Our investment philosophy has been shaped by decades of research by leading academics. We structure portfolios on the principles that markets are efficient; that returns are determined by asset allocation decisions, and that portfolios can be structured around dimensions of expected returns identified through academic research. It is through our strategic partnership with Dimensional Fund Advisors, a leading global investment firm that has been translating academic research into practical investment solutions since 1981, that we can pursue dimensions of higher expected returns through advanced portfolio design, management, and trading.

Much of what we have learned about expected returns in the equity and fixed income markets can be summarized in these dimensions.

- Stocks have higher expected returns than bonds – it has been well documented over time that stocks outperform bonds, and that risk = reward

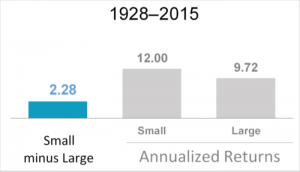

- Among stocks, expected return differences are largely driven by company size – small companies have higher expected returns than large companies.

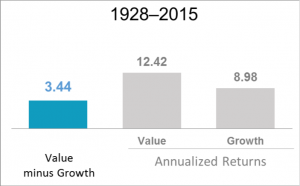

- Relative price – low relative price “value” companies have higher expected returns than high relative price “growth companies.

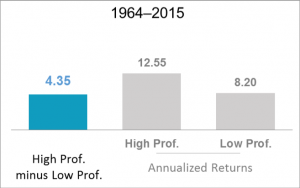

- Profitability – companies with high profitability have higher expected returns than companies with low profitability.

Since 1981, Dimensional has incorporated rigorous academic research on the capital markets into the design, management, and trading of clients’ portfolios. Some of the major milestones in academic research shown in the chart below have had a profound effect on our investment philosophy.

Our enduring philosophy and deep working relationships with Dimensional and the academic community underpin our approach to investing. Over a long period of time, Academics have been able to identify dimensions of higher expected returns, and with Dimensional, we can structure portfolios around these dimensions in a very cost-effective manner.