Over the last several years, index funds have received increased attention from investors and the financial media.

Some have even made claims that the increased usage of index funds may be distorting market prices. For many, this argument hinges on the premise that indexing reduces the efficacy of price discovery. If index funds are becoming increasingly popular and investors are “blindly” buying an index’s underlying holdings, sufficient price discovery may not be happening in the market. But should the rise of index funds be a cause of concern for investors? Using data and reasoning, we can examine this assertion and help investors understand that markets continue to work, and investors can still rely on market prices despite the increased prevalence of indexing.

Many buyers and sellers

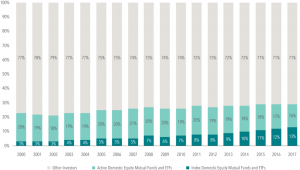

While the popularity of indexing has been increasing over time, index fund investors still make up a relatively small percentage of overall investors. For example, data from the Investment Company Institute shows that as of December 2017, 35% of total net assets in US mutual funds and ETFs were held by index funds, compared to 15% in December of 2007. Nevertheless, the majority of total fund assets (65%) were still managed by active mutual funds in 2017. As a percentage of total market value, index-based mutual funds and ETFs also remain relatively small. As shown in Exhibit 1, domestic index mutual funds and ETFs comprised only 13% of total US stock market capitalization in 2017.

Exhibit 1. Investor Breakdown in the US Stock Market as a Percentage of Total US Stock Market Capitalization

In this context, it should also be noted that many investors use nominally passive vehicles, such as ETFs, to engage in traditionally active trading. For example, while both a value index ETF and growth index ETF may be classified as index investments, investors may actively trade between these funds based on short-term expectations, needs, circumstances, or for other reasons. In fact, several index ETFs regularly rank among the most actively traded securities in the market.

Beyond mutual funds, there are many other participants in financial markets, including individual security buyers and sellers, such as actively managed pension funds, hedge funds, and insurance companies, just to name a few. Security prices reflect the viewpoints of all these investors, not just the population of mutual funds.

As Professors Eugene Fama and Kenneth French point out in their blog post titled “Q&A: What if Everybody Indexed?”, the impact of an increase in indexed assets also depends to some extent on which market participants switch to indexing:

“If misinformed and uninformed active investors (who make prices less efficient) turn passive, the efficiency of prices improves. If some informed active investors turn passive, prices tend to become less efficient. But the effect can be small if there is sufficient competition among remaining informed active investors. The answer also depends on the costs of uncovering and evaluating relevant knowable information. If the costs are low, then not much active investing is needed to get efficient prices.”

What’s the volume?

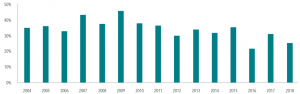

Exhibit 2. Annual Global Equity Market Trading Volume, 2007–2018

In US dollars. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded.

Besides secondary market trading, there are also other paths to price discovery through which new information can get incorporated into market prices. For example, companies themselves can impact prices by issuing stock and repurchasing shares. In 2018 alone, there were 1,633 initial public offerings, 3,492 seasoned equity offerings, and 4,148 buybacks around the world.3 The derivatives markets also help incorporate new information into market prices as the prices of those financial instruments are linked to the prices of underlying equities and bonds. On an average day in 2018, market participants traded over 1.5 million options contracts and $225 billion worth of equity futures.

Hypothesis in practice

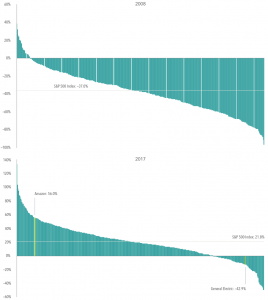

Exhibit 3. Active Manager Performance Has Not Improved

Percentage of Non-Index Equity Funds Outperforming for Three-Year Rolling Period, 2004–2018

Equity mutual fund outperformance percentages are shown for the three-year periods ending December 31 of each year, 2004–2018. Each sample includes equity funds available at the beginning of the three-year period. Outperformers are funds with return observations for every month of the three-year period whose cumulative net return over the period exceeded that of their respective Morningstar category index as of the start of the period. Past performance is no guarantee of future results.

Exhibit 4. Range of S&P 500 Index Constituent Returns

Upper chart includes 2008 total returns for constituent securities in the S&P 500 Index as of December 31, 2007. Lower chart includes 2017 total returns for constituent securities in the S&P 500 Index as of December 31, 2016. Excludes securities that delisted or were acquired during the year. Source: S&P data ©2019 S&P Dow Jones Indices LLC, a division of S&P Global. For illustrative purposes only. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Conclusion

Despite the increased popularity of index-based approaches, the data continue to support the idea that markets are working. Annual trading volume continues to be in line with prior years, indicating that market participant transactions are still driving price discovery. The majority of active mutual fund managers continue to underperform, suggesting that the rise of indexing has not made it easier to outguess market prices. Prices and returns of individual holdings within indices are not moving in lockstep with asset flows into index funds. Lastly, while naysayers will likely continue to point to indexing as a hidden danger in the market, it is important that investors keep in mind that index funds are still a small percentage of the diverse array of investor types. Investors can take comfort in knowing that markets are still functioning; willing buyers and sellers continue to meet and agree upon prices at which they desire to transact. It is also important to remember that while indexing has been a great financial innovation for many, it is only one solution in a large universe of different investment options.