U.S. Performance Dashboard – November 2021

It was not entirely smooth sailing for U.S. equities in November, as concerns about the Omicron strain coupled with less-than-transitory inflation and accelerated tapering by the Fed roiled markets during the last three days of the month. The S&P 500® posted a loss of 1%, outperforming mid and small caps, as the S&P MidCap 400® and S&P SmallCap 600® declined 3% and 2%, respectively. Volatility spiked, as the VIX® closed at 27.19. Growth led among factors, followed by a [...]

On the Mind of Investors : November 7th, Weekly Recap

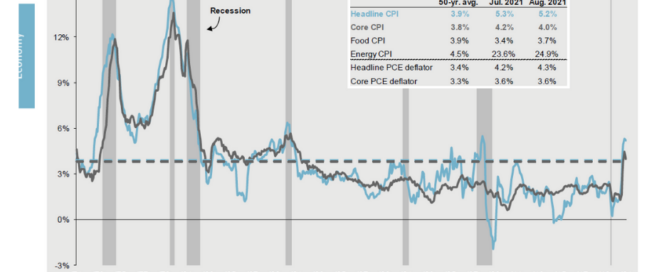

U.S job openings fall to 10.4M PPI for final demand +0.6% in Oct. What to watch in the week ahead: Retail Sales. Inflation has heated up significantly this year as surging consumer demand collided with supply shortages across major sectors of the economy. CPI inflation has been tracking above 5% year-over-year since the start of the summer, with the latest year-over-year gain in CPI at 5.2% overall and 4.0% excluding food and energy. The year-over-year [...]

U.S. Performance Dashboard – October 2021

Despite lingering inflation concerns, U.S. equities recovered strongly in October, thanks to robust corporate earnings. The S&P 500® posted a gain of 7%, outperforming mid- and small-caps, as the S&P MidCap 400® and the S&P SmallCap 600® rose 6% and 3%, respectively. Volatility declined, as the VIX® closed at 16.26. All factors posted gains, with Growth and High Beta in the lead. Unsurprisingly, defensive factors trailed in October. All sectors posted gains. Consumer Discretionary led, followed by Energy, which [...]

October : National Cyber Security Awareness Month – Tips for Protecting Yourself

National Cyber Security Awareness Month is observed each October and is designed to increase the public’s awareness of cybersecurity and cyber-crime issues. To help you protect your personal information, we are sharing content from the American Bankers Association’s brochure “7 Tips for Protecting Yourself Online.” According to Symantec, 12 adults become a victim of cybercrime every second. Though the internet has many advantages, it can also make users vulnerable to fraud. To help protect yourself [...]

Quarterly Market Review – Q3 2021

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios and features a quarterly topic ,"The 50-Year Battle for a Better Way to Invest. Click HERE to download a copy of the report. [...]

U.S. Performance Dashboard – September 2021

Mounting fears of inflation, an ongoing Congressional budget impasse, and anticipation of a reduction in Fed liquidity provision all weighed on U.S. equities in September. For the third quarter as a whole, the S&P 500® posted a gain of 1%, while mid and small-caps declined, as the S&P MidCap 400® and the S&P SmallCap 600® fell 2% and 3%, respectively. Volatility rose, as the VIX® closed at 23.14. Momentum and Growth led in Q3, while High Beta (unsurprisingly) and [...]