US Equity Performance Dashboard – November 2020

A major reversal in the U.S. markets occurred in November, thanks to promising developments on COVID-19 vaccines along with a putatively benign outcome of the Presidential and Congressional elections. The S&P 500® gained 11%, its best performance since April, while smaller caps outperformed, with the S&P MidCap 400® and the S&P SmallCap 600® rising 14% and 18%, respectively. Volatility declined, as VIX® closed the month at 20.57. All factor indices gained, as High Beta and Enhanced Value strategies topped [...]

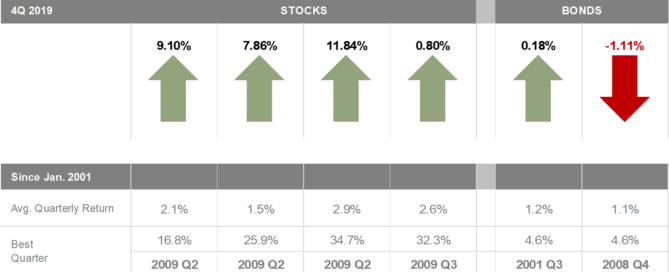

Quarterly Market Review – Q3 2020

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios and features a quarterly topic. Click HERE to download this quarter’s breakdown!

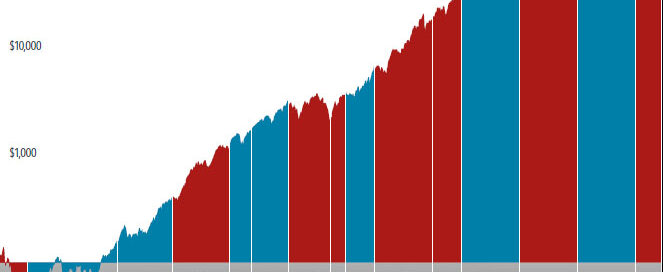

What History Tells Us About US Presidential Elections and the Market

It’s natural for investors to seek a connection between who wins the White House and which way stocks will go. But a look at history underscores that shareholders are investing in companies, not a political party.

How Much Impact Does the President Have on Stocks?

Click HERE to download this interactive exhibit that examines market and economic data for nearly 100 years of US presidential terms.