August Performance Dashboard

U.S. equities stumbled in August, buffeted by economic implications of an inverted yield curve and a possible trade war with China. Large-caps declined, with the S&P 500® down 2%, while the S&P MidCap 400® and S&P SmallCap 600® performed even worse, down 4% and 5%, respectively.

International markets also struggled, with the S&P Developed Ex-U.S. and the S&P Emerging BMI down 3% and 4%, respectively. The Far East and Latin America were particularly weak.

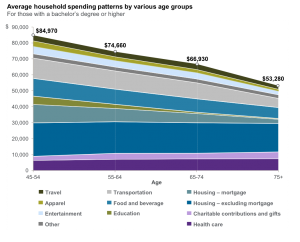

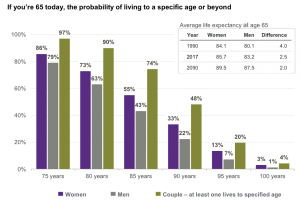

Life expectancies in the United States continue to increase as more people are living to older ages than ever before.

Life expectancies in the United States continue to increase as more people are living to older ages than ever before.