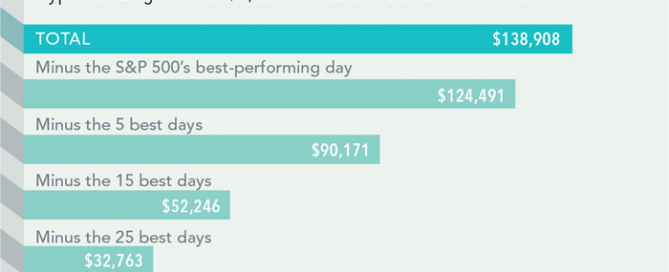

What Happens When you Fail at Market Timing?

It’s hard to predict the best days in the markets, and the cost of missing them can be high. The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. A hypothetical $1,000 turns into $138,908 from 1970 through the end of August 2019. Miss the S&P 500’s five best days and [...]

October Performance Dashboard

U.S. equities posted gains in October, bolstered by optimism around trade talks with China, strong earnings, and easing from the Fed, although Chairman Powell signaled a likely pause on future rate cuts. The S&P 500® and the S&P SmallCap 600® both gained 2%, while the S&P MidCap 400® gained 1%. International markets also gained, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both up 4%. Enhanced Value continued to outperform in October, and Value again outperformed [...]

Kids’ future or yours? 6 Tips to Balance College and Retirement

Get the facts about saving for retirement and college at the same time. Understanding that funding each is equally important, and that even a late start is a good start. Every dollar saved is a dollar you don't have to borrow.

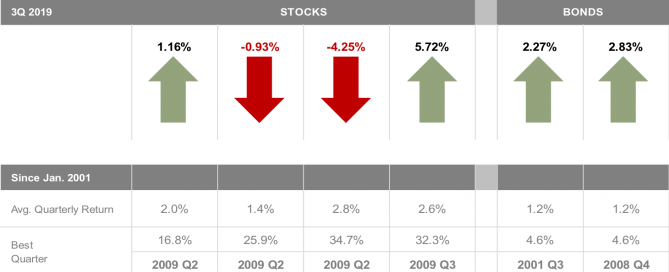

Quarterly Market Review Q3 – 2019

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios and features a quarterly topic. Click HERE to download this quarter's breakdown!

September Performance Dashboard

In spite of slowing economic growth, ongoing trade tensions and a presidential impeachment inquiry, U.S. equities recovered in September to end the third quarter on a positive note. Year-to-date, large-caps outperformed mid- and small-caps, with the S&P 500® up 21%, while the S&P MidCap 400® and S&P SmallCap 600® gained 18% and 13%, respectively. Despite gains in September, international markets ended the quarter with losses while holding on to year-to-date gains, with the S&P Developed Ex-U.S. and the [...]

Get a FREE benefits review!

It's open enrollment in the American workplace every fall, and employers will begin to pass out packets, forms, memos, hold meetings and launch apps for the benefits enrollment season. Navigating your benefits package can be overwhelming, and has a direct effect on your long-term savings. WE WANT TO HELP! Below is your quick guide to navigating your benefits booklet from start to finish: Health Insurance – pay close attention to the following variables to the health [...]