Top 8 Reasons to Choose a Solo 401k – SIGN UP BELOW BY 12/31/19!

8 REASONS TO BEAT THE DEADLINE! SIGN UP FOR A CONSULTATION HERE! Solo 401ks are cost-effective, powerful retirement vehicles. They are designed for self-employed workers who have no employees other than a spouse. They allow small-business owners to stash away much more for retirement than they could stash in a traditional IRA or a SEP IRA, while avoiding the expense and paperwork of setting up a full traditional 401(k) plan. 1) Generous Contribution [...]

Video series: Retirement Readiness #2 – How Much Should I Save for Retirement?

Check out this second installment of the Retirement Readiness series! How much should you save for retirement? Marlena Lee, PhD, discusses important factors that can help you meet your goals, like determining your savings rate, monitoring your progress, and making adjustments over time. This My Retirement Income Calculator can help give you a sense of how much income your savings could provide in retirement.

Video series: Retirement Readiness #1 – Monitoring Your Progress

When planning for retirement, it’s important to keep in mind how much spending your savings can support. The decisions you make today can help improve your retirement readiness. Beyond determining how much money to save, it’s useful to think about retirement in terms of how much income you’ll need after you stop working. Dimensional’s My Retirement Income Calculator can help give you a sense of how much income your savings could provide in retirement. Enjoy our Retirement Readiness series [...]

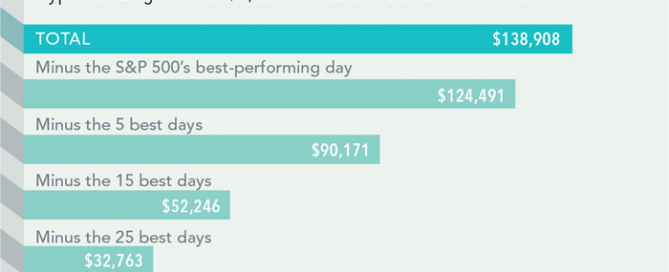

What Happens When you Fail at Market Timing?

It’s hard to predict the best days in the markets, and the cost of missing them can be high. The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. A hypothetical $1,000 turns into $138,908 from 1970 through the end of August 2019. Miss the S&P 500’s five best days and [...]

October Performance Dashboard

U.S. equities posted gains in October, bolstered by optimism around trade talks with China, strong earnings, and easing from the Fed, although Chairman Powell signaled a likely pause on future rate cuts. The S&P 500® and the S&P SmallCap 600® both gained 2%, while the S&P MidCap 400® gained 1%. International markets also gained, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both up 4%. Enhanced Value continued to outperform in October, and Value again outperformed [...]