Thinking about Social Security? Let’s talk options.

When to claim social security benefits is one of the biggest questions when thinking about retiring. Your retirement income will likely come from various sources, and each will fit into your financial plan in different ways. Still, for most people, social security represents a risk-free source of retirement income. How do you maximize that income? It’s a delicate balance.

Social Security Basics

You can receive social security if you are age 62 or older and have enough work credits. You are eligible if you have 40 quarters of work history. The amount you receive is based on your lifetime earnings. Social security calculates your benefit using the 35 years you earned the most. The calculation will include zeros if you don’t have 35 years of work history. You can find out if you’ve already qualified by going to www.ssa.gov. You can set up an account, get estimates of your benefits, and review your work history to ensure it’s correct.

The Social Security Administration (SSA) defines retirement benefits as Early, Full and Late. The SSA’s goal is to make social security flexible enough to work for people in different situations and be as equal as possible. Full retirement age is the benchmark for benefits. If you retire before full retirement age, monthly benefits will be lower to equalize the longer amount of time they will be paid out. People who delay retirement receive higher monthly benefits.

Early retirement begins at age 62. Social security has a formula to reduce your benefits if you claim early retirement. It depends on how many months you claim before your full retirement age. For example, someone with a full retirement age of 67 who retires at 62 will see benefits reduced by 30% for the entire time they claim benefits.

Full retirement age (FRA) depends on your birth year. For most people, it’s somewhere between 65-67. This is the age at which you qualify for full benefits.

Late retirement kicks in after your FRA and extends to age 70. For every year that you delay benefits after your FRA, you get an 8% increase in your benefits for life.

The Spousal Option

When it comes to claiming social security, it’s not always just about your working life. Claims may be made on personal work history or a spouse’s work record. If the marriage lasted at least ten years, a claim can also be made on an ex-spouse’s work record. The spousal benefit amount can be up to 50% of the higher earner’s benefits. The same rules on retirement age apply.

The spousal option also applies to surviving spouses, but the eligibility age is reduced to 60. Reduced benefits will still apply.

Claiming Strategies for Married Couples

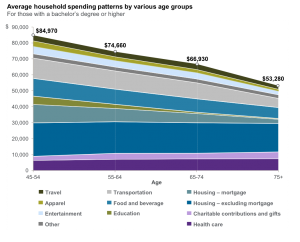

The decision of when to claim is unique to everyone and should be made by thinking through other sources of income, level of health, family history, and overall retirement goals. Delaying the claim will result in higher monthly payments, but it shouldn’t be the only consideration.

It’s a bit more complicated for married couples as each will likely have a different FRA and a different benefit amount. Making use of these differences to maximize the benefit can make sense. For example, claiming early or at FRA for the lower-earning spouse and delaying the higher-earning spouse’s benefits can result in significantly more income.

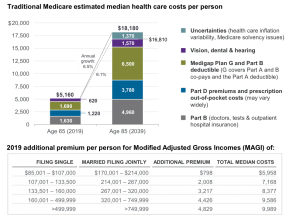

Taxes on Social Security Income

Depending on the tax status of other retirement income, up to 85% of social security benefits can be taxable. Income from pensions, interest, dividends, withdrawals from tax-deferred accounts, and other sources of income can all create a tax liability on social security income.

How you structure your overall retirement plan can help avoid these taxes. Whether taxable, tax-deferred, or tax-free, the types of accounts that assets are held in can create a more flexible income stream. Using a Roth conversion to avoid required minimum distributions is another strategy that can be deployed to keep income lower.

The Bottom Line

Social security is a benefit not only in the income it provides – which can add up to more than $1 million over retirement for a couple that claims at FRA – but it can also be a source of guaranteed income that can anchor an investment plan.

Looking at all your assets, understanding your risk tolerance, and having a sense of your goals and how you want to achieve them can help you make the right decision when it comes to claiming the benefits you worked for over the years.

This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.