U.S. Performance Dashboard – July 2022

After a tumultuous first half of the year, U.S. equities staged a stellar comeback in July, driven by Big Tech outperformance and anticipation of a potential slowing in the pace of future rate hikes by the Fed. The S&P 500® posted a gain of 9%, while the S&P MidCap 400® and S&P SmallCap 600® performed relatively better. All factor indices posted gains, with High Beta and Growth in the lead. All sectors posted gains, with Consumer Discretionary [...]

U.S. Performance Dashboard – February 2022

U.S. equities faced a challenging February, with escalating geopolitical concerns including Russia's invasion of Ukraine along with uncertainty over the Fed's rate hike trajectory resulting in the S&P 500® briefly trading in official correction territory. Smaller-caps outperformed, with the S&P MidCap 400® and S&P SmallCap 600® both up 1%. International performance was also disappointing, with the S&P Developed Ex-U.S. BMI down 1% and the S&P Emerging BMI down 3%, as swings in oil prices amid Ukraine-Russia tensions roiled [...]

Thinking about Social Security? Let’s talk options.

When to claim social security benefits is one of the biggest questions when thinking about retiring. Your retirement income will likely come from various sources, and each will fit into your financial plan in different ways. Still, for most people, social security represents a risk-free source of retirement income. How do you maximize that income? It’s a delicate balance. Social Security Basics You can receive social security if you are age 62 or older and [...]

U.S. Performance Dashboard – January 2022

Anxiety about impending rate hikes as well as a tapering in asset purchases by the Fed to combat inflation led to the worst monthly performance for U.S. equities since March 2020, with the S&P 500® down 5% in January. Smaller caps performed even worse. International performance was also disappointing, with the S&P Developed Ex-U.S. BMI down 5%. The S&P Emerging BMI, down 1%, fared slightly better, aided by strong performance in Latin America, although headwinds included [...]

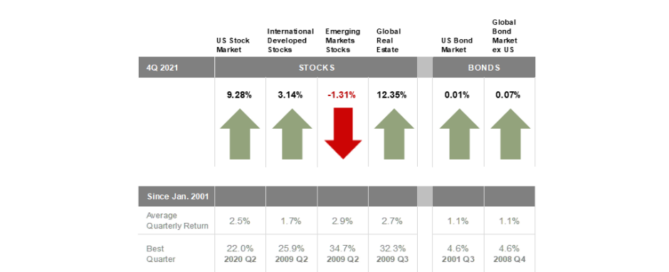

Quarterly Market Review – Q4 2021

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the impact of globally diversified portfolios and features a quarterly topic. "All-Time High Anxiety". Click HERE to download a full copy of the report.

U.S. Performance Dashboard – December 2021

Despite the ongoing pandemic, record inflation, and looming rate hikes, U.S. equities had a banner year, with the S&P 500® reaching 70 closing highs on its way to a 29% return. Mega-caps outperformed, with the S&P 500 Top 50 up 31%. International performance was positive, with the S&P Developed Ex-U.S. BMI up 11%. Emerging markets managed to eke out a gain, with the S&P Emerging BMI up 1% despite large losses in the S&P China BMI, [...]