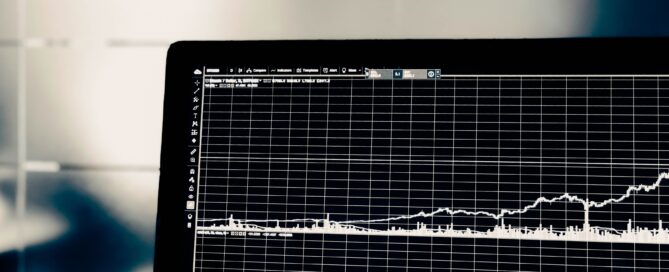

U.S. Performance Dashboard – August 2021

U.S. equities continued to march upward in August, climbing above 20% YTD. The S&P 500® posted a gain of 3% for the month, as the Fed's dovish tone, combined with strong earnings reports, buoyed the market. While mega caps led, mid and small caps also posted gains, with the S&P MidCap 400® and the S&P SmallCap 600® both up 2%. Volatility declined, as the VIX® closed at 16.48. All factors posted gains. "Risk-on" factors (e.g., Momentum and Growth) led [...]

Donor Advised funds: Tax Benefits, Growth and Control

Donor advised funds have been around for decades, but they’ve only become popular vehicles for charitable giving over the last several years. They offer immediate tax benefits as the assets or funds in the donor advised fund convey a tax deduction in the year in which they are gifted. Inside the fund, the assets can grow tax-free and not have to be distributed immediately to a charity. How popular are they? Total assets in donor-advised [...]

Considering Private Real Estate?

Today's ultra-low-rate environment has created a path for other investment options to emerge in the market. Historically, over the last 10 years private real estate has delivered: Higher average yields that stocks, bonds, or traded REITs Higher returns than fixed income with less volatility than stocks "Consider the 4.8% average yield generated by privately held real estate over the last 10 years. This is well above the 2.2% and 2.0% averaged by US fixed [...]

U.S. Performance Dashboard – July 2021

U.S. equities generally managed to end July in positive territory, with the S&P 500® posting a gain of 2%, despite concerns about slowing economic growth, the possible impact of the COVID "delta variant", and rising inflation. Mid-caps posted slight gains, with the S&P MidCap 400® up 0.3%, and small-caps declined, as the S&P SmallCap 600® fell 2%. Volatility rose, with the VIX closing at 18.24. Most factors posted gains, with the unlikely combination of Growth and [...]

Taxes and Retirement – What is Important to Consider

You’ve figured out your budget, your retirement nest egg is substantial, and you’re ready to make the transition to living on income from savings instead of income from work. But have you thought through the tax implications? It’s very common for tax planning to be overlooked, under the assumption that you’ll be in a lower tax bracket and Social Security payments aren’t fully taxed. In fact, a recent study found that 57% of Americans rarely [...]

2021 Financial Wellness: Mid Year Check-In

July marks the mid-point of the year. With kids out of school and the prospect of real, not-in-the-backyard vacation this year, it can be easy to put off thinking about some of the things you need to do consistently to keep your entire financial picture in focus. Below are a few things you should be thinking about as we head into the second half of the year. We’ve organized them by life-stage, from having small [...]