Retirement Insights Tip #5: The Power of Tax Deferred Compounding

Deferring the tax on investment earnings, such as dividends, interest or capital gains, may help accumulate more after-tax wealth over time than earning the same return in a taxable account. This is known as tax-deferred compounding. This chart shows an initial $100,000 after-tax investment in either a taxable or tax-deferred account that earns a 6% return (assumed to be subject to ordinary income taxes). Assuming an income tax rate of 24%, the value of the tax-deferred account (net of taxes owed) after 30 years accumulates over $79,000 more than if the investment return had been taxed 24% each year.

Deferring the tax on investment earnings, such as dividends, interest or capital gains, may help accumulate more after-tax wealth over time than earning the same return in a taxable account. This is known as tax-deferred compounding. This chart shows an initial $100,000 after-tax investment in either a taxable or tax-deferred account that earns a 6% return (assumed to be subject to ordinary income taxes). Assuming an income tax rate of 24%, the value of the tax-deferred account (net of taxes owed) after 30 years accumulates over $79,000 more than if the investment return had been taxed 24% each year.

Choosing to shelter investment growth in tax-deferred accounts over the long term may result in more wealth for retirement. The value of tax deferral in this example is equivalent to a .7% higher annual return over the time period. TAXES CAN WAIT!

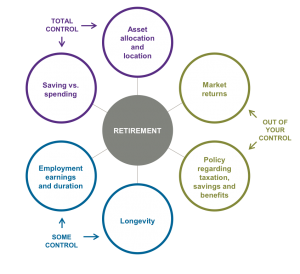

THE RETIREMENT EQUATION

THE RETIREMENT EQUATION