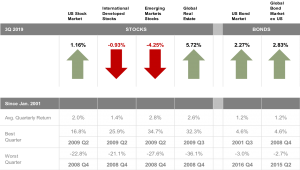

A Core principle of the Park + Elm’s Investment Strategy is investing efficiently, and adding value by analyzing and reducing portfolio expenses. We focus on partnering with firms that value those same principles, in order to deliver a cost efficient, research based portfolio for our clients.

We are thankful to be partners with a well-respected organization that recently announced fee reductions. As a fiduciary, we continuously analyze the cost of building a portfolio, and work with partners that add value through reducing expenses. Dimensional Fund Advisors is pleased to announce a reduction in management fees or expense caps for 77 US Mutual Funds effective February 28, 2020.

Across Dimensional US Funds, there will be an average management fee reduction of 8% on an asset-weighted basis. Many of Dimensional’s most widely held funds, including the flagship Core, Value and Fixed Income portfolios, will see management fee reductions. For a full list of the changes, please refer to the table below.

“We evaluate expense ratios and management fees for every fund on an ongoing basis and look to make adjustments where appropriate,” said Co-CEO Dave Butler. “We have made previous reductions to US Fund management fees or expense caps in 2015, 2017, and 2019.”

“We expect to do better than benchmarks and peers, after fees, so we fight for every basis point,” noted Gerard O’Reilly, Co-CEO and CIO. “We continue to gain insights from research and innovate across all aspects of our process.”

EXHIBIT A

Dimensional US Mutual Funds – Management Fees

EXHIBIT B

Dimensional US Mutual Funds – Total Management Fee Limit

EXHIBIT C

Dimensional US Mutual Funds – Expense Limitation Amount

This is a BIG deal. This will positively affect our portfolio values, and, long-term, can make an impactful difference in retirement. Investing in equity markets can be risky and volatile, but expenses are one controllable aspect of an investment strategy. These efforts also confirm that Park + Elm and Dimensional are working to give clients the best products, in the most efficient way.