Six Simple Truths About Volatility

Volatility is back. Just as many people were starting to think markets only ever move in one direction, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good. There are a number of tidy-sounding theories about why markets have become more volatile. Among the issues frequently splashed across newspaper front pages: global growth fears, rising [...]

Park + Elm Investing Principle #8: Do Emotions Affect Investment Returns?

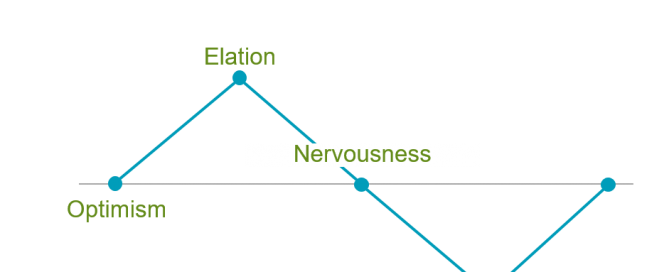

PRINCIPLE #8 IS HERE! Do Emotions affect Investment Returns! Download the rest of our Ebook Here to get all 10 principles!! Many people struggle to separate their emotions from investing. The chart above shows the correlation between emotional cycles and market returns. Investors typically buy at “Elation” and sell at “Fear”, inherently creating a dreaded “selling low, buying high” strategy. A philosopher once said that nothing is as difficult for people as not deceiving themselves. But while [...]

Quarterly Market Review: Q3-2018

Click on the link below for a detailed analysis of quarterly performance of the global equity and fixed income markets. CLICK HERE TO READ THE 3RD QUARTER 2018- QUARTERLY MARKET REVIEW

Total Cost of Ownership

Costs matter. Whether you’re buying a car or selecting an investment strategy, the costs you expect to pay are likely to be an important factor in making any major financial decision. People rely on a lot of different information about costs to help inform these decisions. When you buy a car, for example, the sticker price indicates approximately how much you can expect to pay for the car itself. But the costs of car ownership [...]

Park + Elm Investing Principle #7: Avoid Market Timing

PRINCIPLE #7 IS HERE! AVOID MARKET TIMING! Download the rest of our Ebook Here to get all 10 principles!! You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur. Trying to correctly time your entry point to the market is difficult, and unfortunately humans have an instinctive desire to take control and make a change when things aren’t moving [...]

Today’s Video: Do Mutual Funds Outperform Benchmarks?

Our partner, Dimensional Fund Advisors' analysis of US-based mutual funds shows that only a small percentage of funds have outperformed industry benchmarks after costs—and among top-ranked funds based on past results, only a small percentage have repeated their success. Check out the short video!