Why Should You Diversify?

As 2019 approaches, and with US stocks outperforming non-US stocks in recent years, some investors have again turned their attention towards the role that global diversification plays in their portfolios. For the five-year period ending October 31, 2018, the S&P 500 Index had an annualized return of 11.34% while the MSCI World ex USA Index returned 1.86%, and the MSCI Emerging Markets Index returned 0.78%. As US stocks have outperformed international and emerging markets stocks [...]

Park + Elm Investing Principle #9: Look Beyond the Headlines

PRINCIPLE #9 IS HERE! Look Beyond the Headlines!! Download the rest of our Ebook Here to get all 10 principles!! Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future while others tempt you to chase the latest investment fad. When tested, consider the source and maintain a long-term perspective. Why doesn’t the media run more good news? Because bad news sells! It sells because fear is a more powerful [...]

Today’s Video: Retirement Rediness – How to Invest!

Focusing on INCOME when investing for retirement, and following a strategy that addresses the RISKS that can affect your future income and standard of living is extremely important! Many are saving and investing to support future spending, but most are focused on a magic number, not the income that a that number can support. Check out this short but informative clip on developing an income focused plan!

It’s Enrollment Time! Here’s What you Need to Know!

Fall is open enrollment in the American workplace, and you've probably already received you packets, forms, memos, meeting invites and apps for the benefits enrollment season. Navigating your benefits package can be overwhelming, and has a direct effect on your long-term savings. Park + Elm wants to help. Below is your quick guide to navigating your benefits booklet from start to finish: Health Insurance – pay close attention to the following variables to the health insurance [...]

IRS Boosts Contribution Limits for 2019!

Here's a great New Year's Resolution for 2019...Save more in your retirement accounts! The IRS is on board! They recently announced new contribution limits for 401(k) participants and IRA account holders. Here's how much you can sock away toward retirement in 2019: In 2019, you will be able to save up to $19,000 in your 401(k) or 403(b), up from $18,500 in 2018. The limit for individual retirement accounts will be $6,000 - up [...]

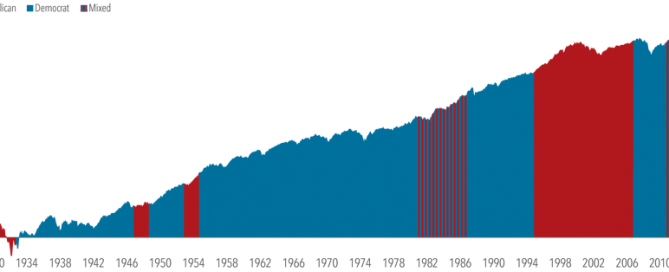

Midterm Elections: What Do They Mean for Markets?

It’s almost Election Day in the US once again. For those who need a brief civics refresher, every two years the full US House of Representatives and one-third of the Senate are up for reelection. While the outcomes of the elections are uncertain, one thing we can count on is that plenty of opinions and prognostications will be floated in the days to come. In financial circles, this will almost assuredly include any potential for [...]