Park + Elm Investing Principle #4: Let Markets Work for You!

Principle #4 is HERE! Let Markets Work for You!

Download the rest of our Ebook Here to get all 10 principles!!

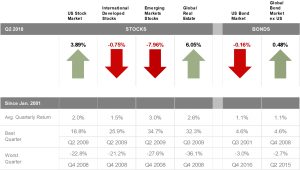

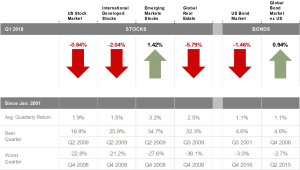

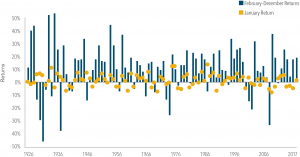

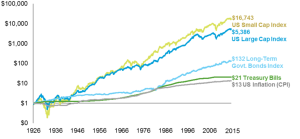

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets throughout the world have provided growth of wealth that has more than offset inflation. Companies compete with each other for investment capital, and millions of investors compete with each other to find the most attractive returns. This competition quickly drives prices to fair value, ensuring that no investor can expect greater returns without bearing greater risk. The chart below shows how the growth of $1 is affected by the level of risk an investor is willing to take. It also shows that any level of risk taken has historically outpaced inflation.

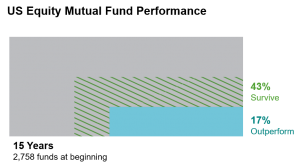

Many investors and investment managers strive to beat the market by taking advantage of pricing “mistakes” and attempting to predict the future. Too often, this proves costly and futile, due to holding the wrong securities at the wrong time, meanwhile, markets are succeeding. Instead of allowing the media to sway you into making impulsive and reactive decisions about your investments, or gambling on hunches, why not let the markets work for you?

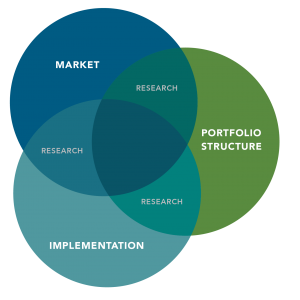

When you try to outwit the market, you compete with the collective knowledge of all investors. By harnessing the market’s power, you put their knowledge to work in your portfolio. Markets integrate the combined knowledge of all participants, and enables competition among those who voluntarily agree to transact. We believe that all of this powerful information drives security prices to fair value, and that differences in performance are largely attributed to asset allocation decisions, and differences in average risk.

We know that investing in the market means taking risks. We also know that not investing means taking risks, because your money today will buy less in the future. We want investors to incorporate the vast, complex network of information, expectations, and human behavior that we believe markets reflect, into their portfolio design. This powerful view of market equilibrium has profound investment implications.