Yield vs. Total Return

Many investors, including retirees, rely on their investment portfolio to fund their cash needs. This need can be approached in one of two ways. In this blog, we explore the yield vs. total return approaches to generating income in a portfolio, and address misconceptions about the benefits of emphasizing dividend and interest income at the expense of other portfolio issues.

Using Interest and/or Dividends from securities to fund cash flow needs

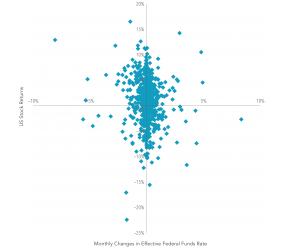

The traditional appeal to this method stems from the belief that stocks paying high dividends are less risky because they offer a regular stream of payments to investors. Before you determine this is the favorable route, keep in mind that the amount of dividend and interest income generated by a portfolio is largely determined by dividend policies of the firms and prevailing market interest rates. Both of these are variables outside an investor’s control. Dividend payments are not created out of thin air. They flow from a company’s earnings or assets, which are reflected in the current stock price.

DID YOU KNOW when a company pays a dividend, its stock price is reduced by an amount approximately equal to the dividend itself? So even when accounting for the cash received, the portfolio value may remain unchanged. While you may not have to liquidate assets for cash flow, the economic impact may be essentially the same.

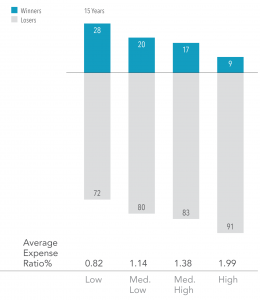

The key is not to allow your preference for yield to influence your asset allocation by focusing on securities with higher yields. Let’s look at the numbers:

- A dividend-focused portfolio would exclude 35%–40% of stocks globally, resulting in lower diversification and hence, higher risk

- Global portfolios holding only dividend-paying stocks exclude about 47% of the available small cap stock universe, which historically has offered higher average returns than large cap stocks

- Dividends are not certain or guaranteed. As demonstrated in the 2008−2009 financial crisis, companies have reduced dividends after large market declines.

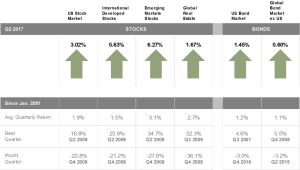

Focusing on TOTAL RETURN to create cash flow

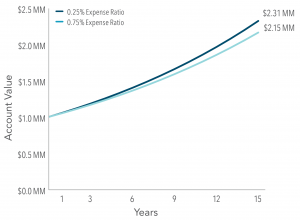

This type of portfolio involves selling assets in the portfolio to create cash flow. This method reflects the idea that, from an investment standpoint, it makes little difference whether returns are delivered as dividends or capital gains. Selling assets also allows greater control over the amount of cash flow generated, and eliminates reliance on dividend yields and interest rates, which are uncontrollable. It may create an opportunity to strategically rebalance by selling assets that are over-weighted relative to the target allocation.

If you follow iconic investor Warren Buffet, you may know that he also believes in the Total Return Strategy. His company, Berkshire Hathaway, has never paid a dividend. His belief is that investors can sell shares if cash is needed, with a timed sale that can capture optimal tax rates. His strategy is to keep the cash in the company, prevent dividends from being double taxed, and use that cash to fund future investments into the company.

CONCLUSION

Investors can have much greater control in generating cash flows by selling securities rather than relying on dividend and interest income. Firms’ payout policies evolve over time, as do market interest rates. Rather than letting portfolio yields determine spending rates, investors can develop a sustainable withdrawal strategy with a financial advisor. If you plan to rely on interest income for cash flow, consider your overall fixed income needs in your portfolio first. Contact us to set up a free portfolio evaluation, and take the first step to a long-term plan. Don’t let an income bias affect your diversification or expected returns.

DO YOU PARTICIPATE?

DO YOU PARTICIPATE?