STOCK PRICES ARE CHANGING EVERY DAY – AND AS PRICES CHANGE, SO DO EXPECTED RETURNS.

STOCK PRICES ARE CHANGING EVERY DAY – AND AS PRICES CHANGE, SO DO EXPECTED RETURNS.

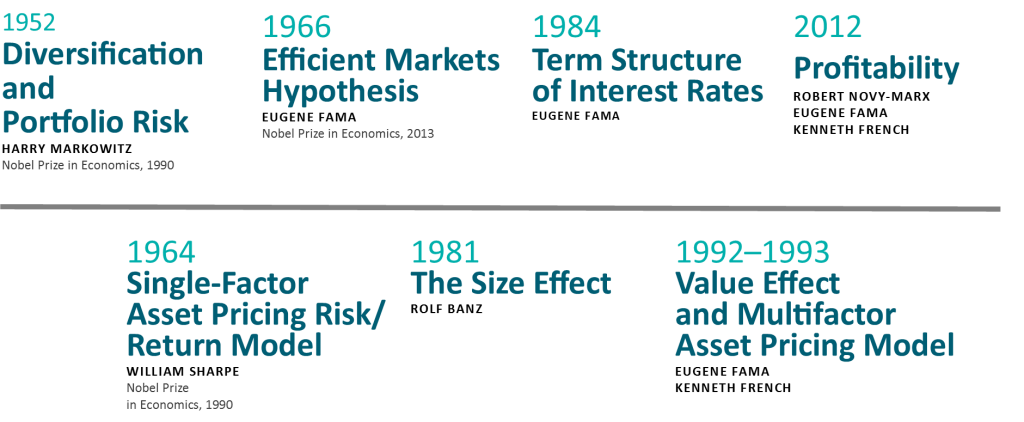

It has been more than 50 years since the idea of stock prices containing all relevant information was put forth. Information might come in the form of data from a company’s financial statements, news about a new product, a change in the regulatory environment, or simply a shift of investors’ tastes and preferences toward owning different investments.

Information is incorporated into security prices through the buying and selling process. While fair prices may

not depend on a certain level of trading, over $400 billion of stocks traded on average each day in the world equity

markets suggests that a great deal of information is incorporated into stock prices.

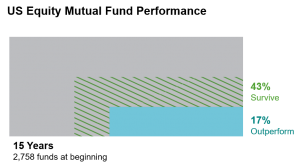

As investors, we should consider whether we want to use the price we observe or look for a better price. A recent

study from Dimensional Fund Advisors shows that over the 15-year period ending December 2017, only 14%

of investment managers that attempted to outguess the market survived and beat benchmarks.

This study is just one of many conducted over the past 50 years that have documented similar results. With investing, many things are out of our control, but we can make decisions that improve our odds of having a positive investment experience. Looking at these results, attempting to identify a better price than the one we observe in the market may not be accomplishing this objective.

WHAT CAN WE LEARN FROM THE PRICE

Beyond the challenge of trying to outguess the market, why is price so important? We should first understand

the connection between the price you pay and the return you expect to receive.

Let’s consider an example: Imagine that you want to buy a house and you know for certain the house will be worth $2 million 10 years from now. If you pay $1 million for the house today or you pay $500,000, in which case would you earn a higher return? Obviously paying less, $500,000, would earn you a higher return.

Of course, investing offers few, if any, guarantees, and we can’t know for certain what something will be worth in the future. Given this, investors should think in terms of expected returns and what decisions will lead to an investment with higher expected returns. Holding other factors constant, the lower the price you pay, the higher the expected return, which is why it’s so important to consider a stock’s observed market price. The price paid has a direct connection to the return we expect to receive.

AS PRICES CHANGE, SO DO EXPECTED RETURNS

We also know that, in a changing world, new information becomes available on a regular basis and that new information can affect the price of stocks. Let’s imagine a pharmaceutical company announces a new drug that investors believe will generate substantial revenues for the company. If this news was previously unknown, once it becomes available, it will likely influence the price of the stock. The price will adjust based on new information, and as the price changes, so will the expected return. Changes in stock prices are taking place every day, and as prices change, so do expected returns.

INDEX MANAGEMENT AND MARKET PRICES

Each year on the last Friday in June, the Russell indices go through a process called reconstitution. In this process, certain stocks are added and deleted from the index. The goal of reconstitution is to periodically rebalance the index to account for historical changes in stocks during the prior period. Index providers, such as S&P, Russell, or CRSP, have different processes for adding and deleting stocks, and while each will have some variation, all will establish pre-set points in time to make their adjustments.

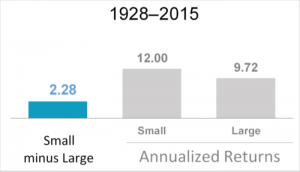

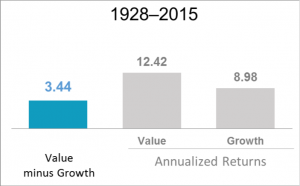

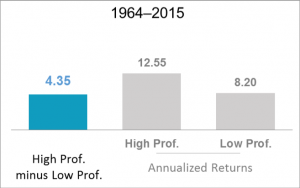

To decide which stocks will be added or deleted, the index provider may look at the market price of a stock to determine what is a small cap vs. large cap stock or what is a value vs. growth stock. It is only during these pre-set dates of reconstitution that index providers might consider market prices. On all other days between the reconstitution dates, changes in the prices of stocks are not being incorporated by the index. And since there is a direct relation between the price of a stock and expected return of a stock, indices are considering differences in expected returns only at infrequent intervals during the year. It not only seems logical that we may want to consider changes in market prices more frequently, the failure to do so can have a direct impact on the expected return of the index.

Again, this is why we believe using market prices is so important. The price we see gives us information about what we expect to receive. If you want to have an investment approach that targets higher expected returns every day, you need to ensure the approach incorporates changes in price every day. Otherwise, investors may not be getting what they think they are paying for.

In US dollars. Based on rolling annualized returns using monthly data. Rolling multiyear periods overlap and are not independent. Fama/French indices provided by Ken French. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

In US dollars. Based on rolling annualized returns using monthly data. Rolling multiyear periods overlap and are not independent. Fama/French indices provided by Ken French. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

STOCK PRICES ARE CHANGING EVERY DAY – AND AS PRICES CHANGE, SO DO EXPECTED RETURNS.

STOCK PRICES ARE CHANGING EVERY DAY – AND AS PRICES CHANGE, SO DO EXPECTED RETURNS.