WHY CHOOSE A SOLO 401(K)?

A solo 401(k) is designed for self-employed people who have no employees other than a spouse. Small-business owners can stash away much more for retirement than they could in a traditional IRA or a SEP IRA, while avoiding the expense and paperwork of setting up a full traditional 401(k) plan.

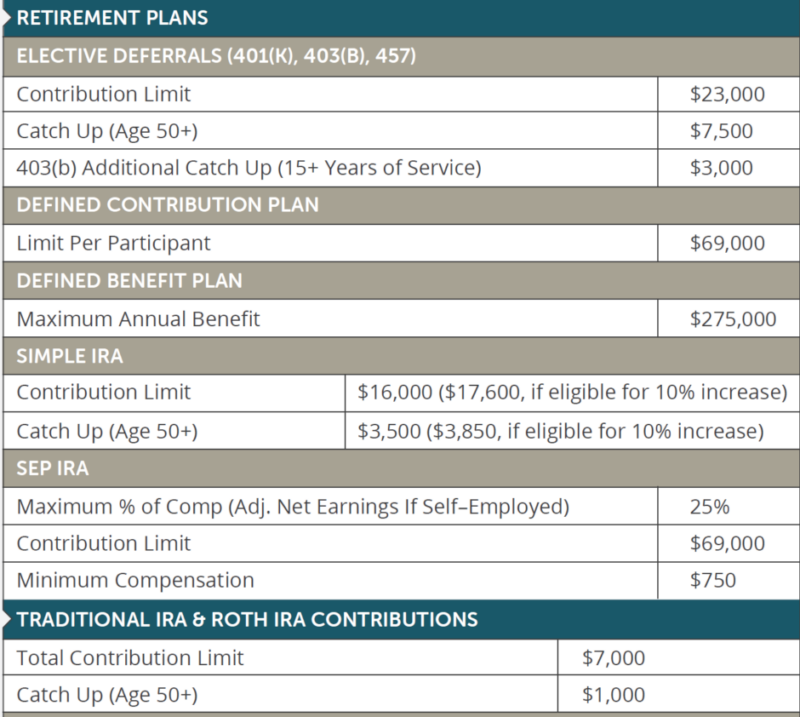

So how does the Solo 401(k) stack up against other retirement plans? Click on the Contribution Limits tab below!

The most important thing is to save money for retirement and lower your current taxes. Contact us TODAY if you want to know more about a Solo 401(k) before the end of the year! The deadline is the end of your business TAX YEAR!

Click on the COMPLIMENTARY DOWNLOAD button to get a copy of our 401(k) Ebook!

EMPLOYEE CONTRIBUTIONS

You can make DISCRETIONARY contributions of up to $22,500 for 2023 as an employee (or $30,000 if you’re 50 or older), even if that is 100% of your self-employed earnings for the year.

PROFIT SHARING

In addition, you can contribute up to 25% of your net self-employment income as an employer (business income minus half your self-employment tax) at a maximum considered compensation of $330,000.

ROTH/LOANS/ROLLOVERS AVAILABLE

Some solo 401(k) providers offer a Roth 401(k) option that allows you to invest some or all of your contributions on an after-tax basis. Not to mention the capability to roll funds in, and borrow from the plan.

ADDITIONAL CONTRIBUTIONS/ROTH CONVERSION

If you’re profit sharing and Employee contributions aren’t enough, make a possible after-tax contribution to max out the 56k limit, and execute a Roth conversion.

DEFINED BENEFIT PLAN FOR HIGH EARNERS

Once you’ve maxed out your Solo 401(k), go for extra credit and look into a Defined Benefit Pension Plan. This supersized retirement plan may allow you to contribute an additional $265,000 pre-tax per year depending on your age and income.