Pursuing a Better Investment Experience #3: Resist Chasing Past Performance

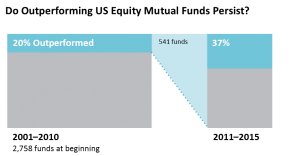

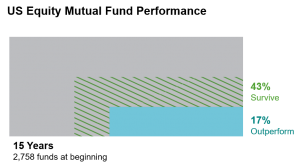

(Research above shows only 20% of all active mutual funds beat their corresponding index over a 10 year time frame. And of those, only 37% continued over the next 5 years. This is only 205 of 2758 mutual funds that beat their index over a 15 year time frame. It’s nearly impossible to pick the right ones)

Some investors select mutual funds based on past returns. However, funds that have outperformed in the past do not always persist as winners. The most important guideline to remember is: If a fund does not fit into your overall investment strategy, it’s a dangerous choice no matter how it’s performed in the recent past.

Investors have a tendency to weight recent events more heavily than history. It’s nearly impossible for the typical investor to choose a fund that had negative returns in the previous year. Yet that fund, historically, may have proven to be an outperformer in its category. And the largest hurdle is that most investors don’t even think they are chasing performance. Research shows, however, that nearly every mutual fund outperforms individual investors in the fund.

Instead of chasing performance, investors should follow on these 4 rules:

1. Develop an investment strategy and COMMIT to it

Every investor should have a disciplined investing strategy and stick to it, through bull and bear markets. A relationship with a professional financial advisor is the first step to developing this strategy, and it insures that you’ll take the right actions at the right time.

2. Rebalance your portfolio

Rebalancing your portfolio will keep you from buying high and selling low. Investors who chase returns, are adding to a piece of the investment pie that’s already too big. If you rebalance your portfolio once a year, you’ll be insured that you’re adding to the smaller piece of the pie, and inherently buying low and selling high.

3. Remain Invested

Don’t be tempted to pull your investments from the market when it falls. These are the most opportune times to increase long-term returns through rebalancing.

4. Focus on your personal goals

Your personal goals should drive your investing strategy. Keep that in the front of your mind and it will be much easier to remain disciplined.

Remember, past performance alone provides little insight into a fund’s ability to outperform in the future. A more disciplined approach has proven to be the best way to increase-long term performance.

Stay tuned-in to our blog for our Ten Part Series highlighting TEN decisions that can help investors target long-term wealth in capital markets. We’ll cover topics from market pricing, efficient markets and diversification; to investing with your emotions, and the Media challenging your discipline. Check back tomorrow for the first of the series: EMBRACE MARKET PRICING

Stay tuned-in to our blog for our Ten Part Series highlighting TEN decisions that can help investors target long-term wealth in capital markets. We’ll cover topics from market pricing, efficient markets and diversification; to investing with your emotions, and the Media challenging your discipline. Check back tomorrow for the first of the series: EMBRACE MARKET PRICING extensive market report…the

extensive market report…the