![educ]](https://park-elm.com/wp-content/uploads/2018/09/educ-300x201.jpg) With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses. NOW is a good time to sharpen one’s pencil for a few important lessons before heading back into the investing classroom to tackle the issue.

With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses. NOW is a good time to sharpen one’s pencil for a few important lessons before heading back into the investing classroom to tackle the issue.

THE CALCULUS OF PLANNING FOR FUTURE COLLEGE EXPENSES

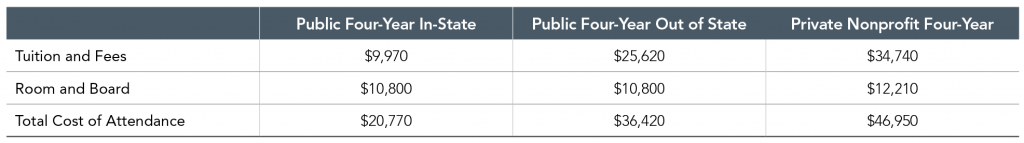

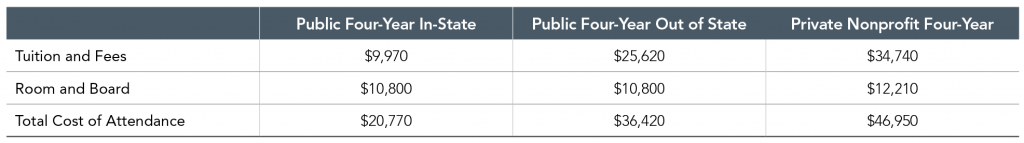

According to recent data published by the College Board, the annual cost of attending college in the US in 2017–2018 averaged $20,770 at public schools, plus an additional $15,650 if one is attending from out of state. At private schools, tuition and fees averaged $46,950.

It is important to note that these figures are averages, meaning actual costs will be higher at certain schools and lower at others. Additionally, these figures do not include the separate cost of books and supplies or the potential benefit of scholarships and other types of financial aid. As a result, actual education costs can vary considerably from family to family.

Exhibit 1. Average Published Cost of Attending College in the US

Source: The College Board, “Trends in College Pricing 2017.”

To complicate matters further, the amount of goods and services $1 can purchase tends to decline over time. This is called inflation. One measure of inflation looks at changes in the price level of a basket of goods and services purchased by households, known as the Consumer Price Index (CPI). Tuition, fees, books, food, and rent are among the goods and services included in the CPI basket. In the US over the past 50 years, inflation measured by this index has averaged around 4% per year. With 4% inflation over 18 years, the purchasing power of $1 would decline by about 50%. If inflation were lower, say 3%, the purchasing power of $1 would decline by about 40%. If it were higher, say 5%, it would decline by around 60%.

While we do not know what inflation will be in the future, we should expect that the amount of goods and services $1 can purchase will decline over time. Going forward, we also do not know what the cost of attending college will be. But again, we should expect that education costs will likely be higher in the future than they are today. So, what can parents do to prepare for the costs of a college education? How can they plan for and make progress toward affording those costs?

DOING YOUR HOMEWORK ON INVESTING

To help reduce the expected costs of funding future college expenses, parents can invest in assets that are expected to grow their savings at a rate of return that outpaces inflation. By doing this, college expenses may ultimately be funded with fewer dollars saved. Because these higher rates of return come with the risk of capital loss, this approach should make use of a robust risk management framework. Additionally, by using a tax-deferred savings vehicle, such as a 529 plan, parents may not pay taxes on the growth of their savings, which can help lower the cost of funding future college expenses.

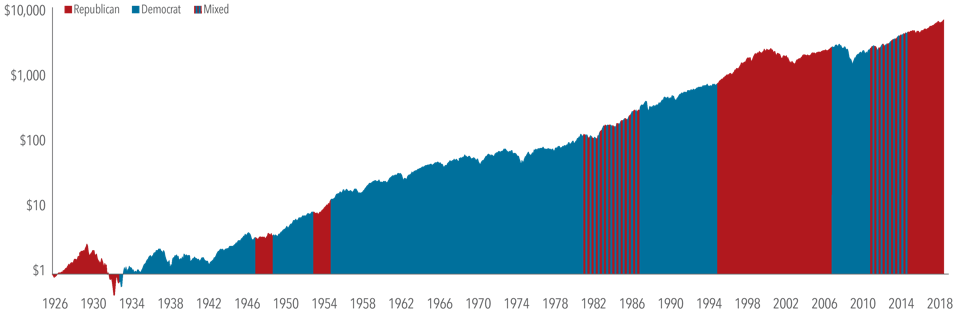

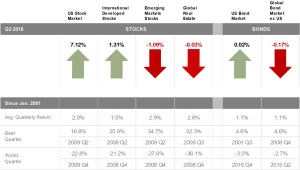

While inflation has averaged about 4% annually over the past 50 years, stocks (as measured by the S&P 500 Index) have returned around 10% annually during the same period. Therefore, the “real” (inflation-adjusted) growth rate for stocks has been around 6% per annum. Looked at another way, $10,000 of purchasing power invested at this rate over the course of 18 years would result in over $28,000 of purchasing power later on. We can expect the real rate of return on stocks to grow the purchasing power of an investor’s savings over time. We can also expect that the longer the horizon, the greater the expected growth. By investing in stocks, and by starting to save many years before children are college age, parents can expect to afford more college expenses with fewer savings.

It is important to recognize, however, that investing in stocks also comes with investment risks. Like teenage students, investing can be volatile, full of surprises, and, if one is not careful, expensive. While sometimes easy to forget during periods of increased uncertainty in capital markets, volatility is a normal part of investing. Tuning out short-term noise is often difficult to do, but historically, investors who have maintained a disciplined approach over time have been rewarded for doing so.

RISK MANAGEMENT AND DIVERSIFICATION: THE FRIENDS YOU SHOULD ALWAYS SIT WITH AT LUNCH

Working with a trusted advisor who has a transparent approach based on sound investment principles, consistency, and trust can help investors identify an appropriate risk management strategy. Such an approach can limit unpleasant (and often costly) surprises and ultimately may contribute to better investment outcomes.

A key part of maintaining this discipline throughout the investing process is starting with a well-defined investment goal. This allows for investment instruments to be selected that can reduce uncertainty with respect to that goal. When saving for college, risk management assets (e.g., bonds) can help reduce the uncertainty of the level of college expenses a portfolio can support by enrollment time. These types of investments can help one tune out short‑term noise and bring more clarity to the overall investment process. As kids get closer to college age, the right balance of assets is likely to shift from high expected return growth assets to risk management assets.

Diversification is also a key part of an overall risk management strategy for education planning. Nobel laureate Merton Miller used to say, “Diversification is your buddy.” Combined with a long-term approach, broad diversification is essential for risk management. By diversifying an investment portfolio, investors can help reduce the impact of any one company or market segment negatively impacting their wealth. Additionally, diversification helps take the guesswork out of investing. Trying to pick the best performing investment every year is a guessing game. We believe that by holding a broadly diversified portfolio, investors are better positioned to capture returns wherever those returns occur.

CONCLUSION

Higher education may come with a high and increasing price tag, so it makes sense to plan well in advance. There are many unknowns involved in education planning, and no “one-size-fits-all” approach can solve the problem. By having a disciplined approach toward saving and investing, however, parents can remove some of the uncertainty from the process. A trusted advisor can help parents craft a plan to address their family’s higher education goals.

Volatility is back. Just as many people were starting to think markets only ever move in one direction, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good.

Volatility is back. Just as many people were starting to think markets only ever move in one direction, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good.

![educ]](https://park-elm.com/wp-content/uploads/2018/09/educ-300x201.jpg) With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses. NOW is a good time to sharpen one’s pencil for a few important lessons before heading back into the investing classroom to tackle the issue.

With school back in session in most of the country, many parents are likely thinking about how best to prepare for their children’s future college expenses. NOW is a good time to sharpen one’s pencil for a few important lessons before heading back into the investing classroom to tackle the issue.