Key Questions for the Long-term Investor

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you’ll likely ask yourself some of the questions below. Trying to answer these questions may be intimidating, but know that you’re not alone. Your financial advisor is here to help. While this is not intended to be an exhaustive list it will hopefully shed light on a few key principles that may help improve investors’ odds of investment success in the long run.

1. What sort of competition do I face as an investor?

The market is an effective, information-processing machine. Millions of market participants buy and sell securities every day and the real-time information they bring helps set prices.

This means competition is stiff and trying to outguess market prices is difficult for anyone, even professional money managers (see question 2 for more on this). This is good news for investors though. Rather than basing an investment strategy on trying to find securities that are priced incorrectly, investors can instead rely on the information in market prices to help build their portfolios (see question 5 for more on this).

2. What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and your odds of getting heads or tails are 50/50. Historically, the odds of selecting an investment fund that was still around 15 years later are about the same. Regarding outperformance, the odds are worse. The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. One needn’t look further than real-world results to see this. Based on research, only 17% of US equity mutual funds and 18% of fixed income funds have survived and outperformed their benchmarks over the past 15 years.

3. If I choose a fund because of strong past performance, does that mean it will do well in the future?

Some investors select mutual funds based on past returns. However, research shows that most funds in the top quartile (25%) of previous five-year returns did not maintain a top-quartile ranking in the following year. In other words, past performance offers little insight into a fund’s future returns.

4. Do I have to outsmart the market to be a successful investor?

Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.

5. Is there a better way to build a portfolio?

Academic research has identified equity and fixed income dimensions, which point to differences in expected returns among securities. Instead of attempting to outguess market prices, investors can instead pursue higher expected returns by structuring their portfolio around dimensions of expected returns like company size, price, profitability and risk.

6. Is international investing for me?

Diversification helps reduce risks that have no expected return, but diversifying only within your home market may not be enough. Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

7. Will making frequent changes to my portfolio help me achieve investment success?

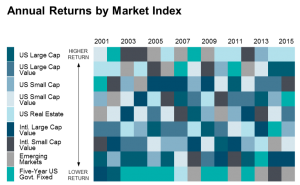

It’s tough, if not impossible, to know which market segments will outperform from period to period.

Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.

8. Should I make changes to my portfolio based on what I’m hearing in the news?

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.

9. So, what should I be doing?

Work closely with a financial advisor who can offer expertise and guidance to help you focus on actions that add value. Focusing on what you can control can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

Contact us Park + Elm today to get started on your long-term plan at 855.PARKELM or [email protected]

Past performance is no guarantee of future results.