Quarterly Market Review – Q3 2020

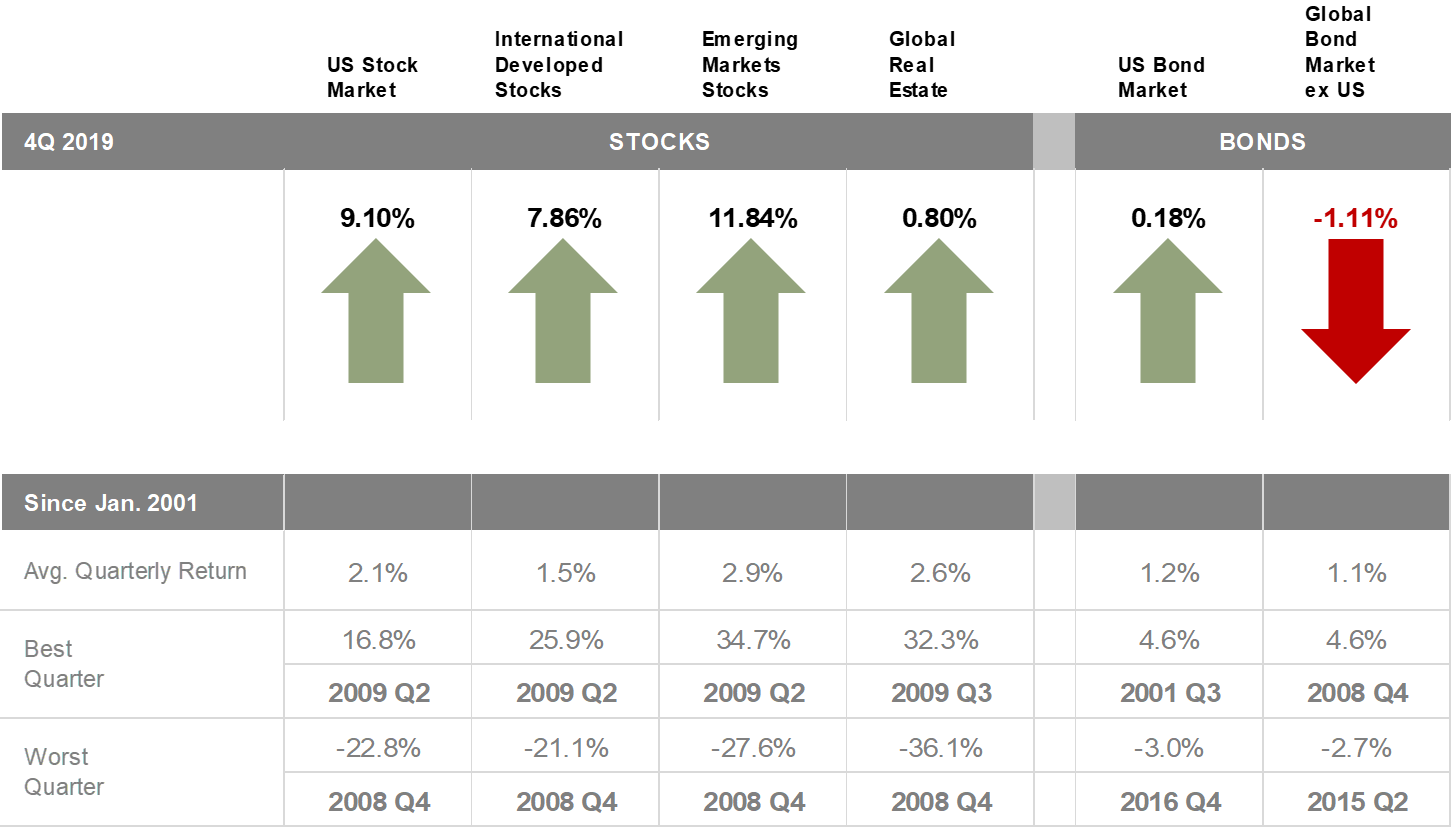

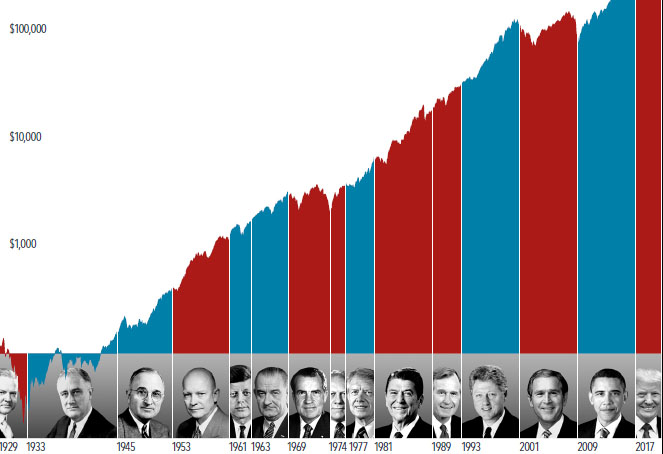

This report features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

The report also illustrates the impact of globally diversified portfolios and features a quarterly topic.